Diversity, Equity and Inclusion in the CPA Industry

Few years ago, at the end of 2016, I walked into a room where I felt everyone was staring at me. This was the first time I felt this way. I am a Certified Public Accountant (CPA), so my workplace was 99% white. At that time, I was one of the few people of color working for the 5th largest CPA firm in the country. There was not much minority representation in this office, but I always felt welcomed and treated with respect. However, on that day and for the upcoming months, I felt like an outcast. The reality is, Latinos make up only 8% of CPAs according to a recent AICPA study.

For the past 60 plus years, minority representation has been recognized as an issue in the accounting industry, particularly in the CPA profession. Although Big Four CPA firms, and professional organizations have made efforts, to increase representation in diverse groups through various initiatives, the measures taken so far haven’t yielded positive results. One of the leading accounting organizations, the AICPA, recognized in the 1960’s that more work needed to be done to increase the diversity pipeline amongst minority groups.

The 1960’s represented a pivotal time in the country with evolving societal changes, the passing of the Civil Rights Act of 1964, which prohibits discrimination on the basis of race, color, religion, sex or national origin. During this time, the AICPA started to focus on minority underrepresentation in the profession, and created the Minority Recruitment and Equal Opportunity Committee, later renamed the Minority Initiatives Committee (MIC).

According to a recent AICPA study, 12% of new CPAs are Asian/Pacific Islanders, 8% are Hispanics or Latinx, and 3% are African Americans. So the question remains, why is there low minority representation in the CPA industry? Few studies have shown that two of the barriers are, high cost of fees to pursue the license, and the 150 college credit requirement. According to these studies, these are the two major barriers of entry amongst minority groups. However, I would like to add one more, the lack of opportunities available to succeed in this field as a member of a minority group; in other words, is there a clear path to make it to a position of leadership e.g., manager, senior manager, managing director, and partner/or principal?

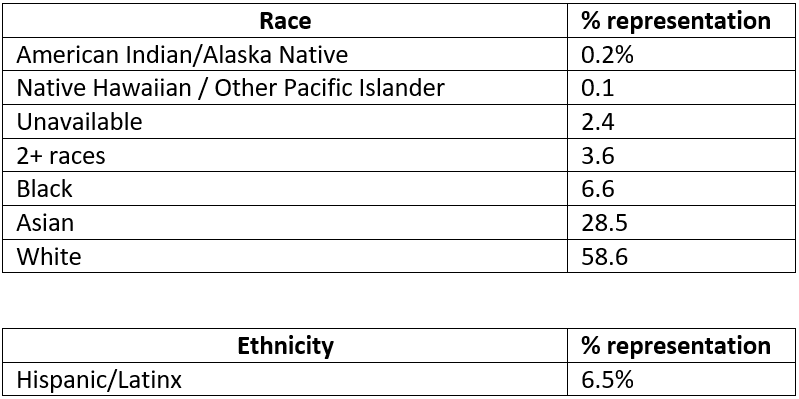

I did some research and gathered some data based on some recent studies performed by two Big Four CPA firms, Deloitte and PwC. These reports share representation data of their workforce, which consists of professionals in various industries; accounting, consulting, information technology, etc. Deloitte’s 2021 DEI Transparency Report’s data was segregated by race and ethnicity, and reflected the following:

The report further broke down the data shown above by job level, race and ethnicity.

The results of the study showed that as the job level increases from Senior/Senior Consultant to PPMD, the % of minority representation decreases amongst the two largest minorities groups, Black and Hispanic/Latinx from 8.3% to 2.1%, and from 7.1% to 3.6%, respectively.

What does this data tell us about the path for minority professionals towards leadership positions?

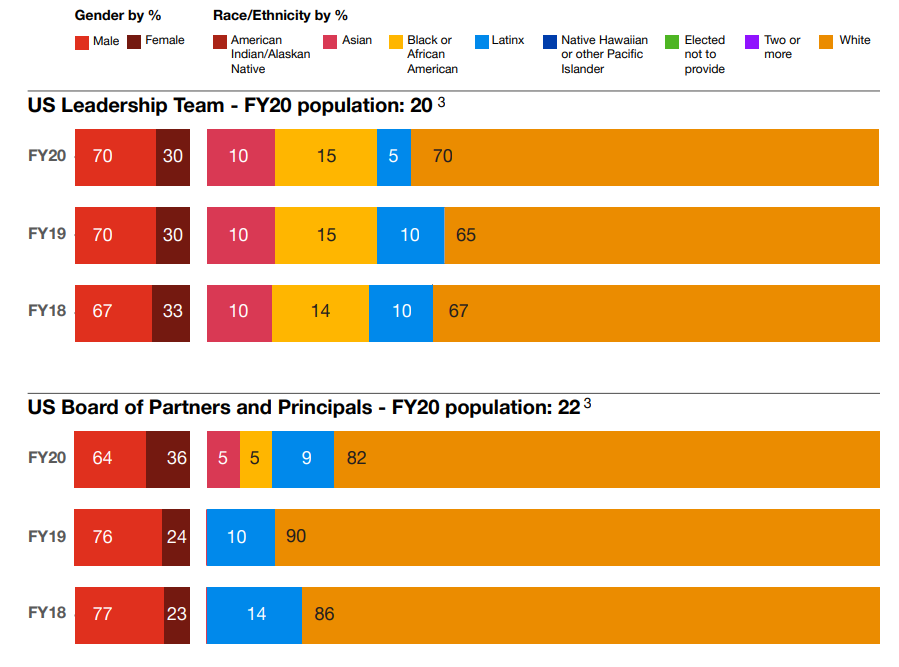

Deloitte’s DEI Report (figure 1) shows evidence that there is a small probability to succeed in the public accounting industry when considering these figures. Blacks and Hispanic/Latinx have a 2.1% and 3.6% chance to become a PPMD, respectively. PwC FY2021 DEI Report (figure 2) showed better percentages regarding Black and Hispanic/Latinx representation in US leadership team positions, with 15% and 5%, respectively. But for US Board of Partners and Principals, the percentages are down to 5% for Black, 9% for Hispanic/Latinx.

Lastly, it is worth to mention the discrepancy between Deloitte and PwC representation of Asians. Deloitte’s Asian’s PPMD workforce represents 13.1%, while PwC shows a 5% representation.

Figure 1. Deloitte FY2021 DEI Transparency Report

Figure 2. PwC FY2021 DEI Transparency Report

What strategies are Deloitte and PwC working on, to increase diversity representation at leadership levels?

Deloitte is focusing on strengthening their inclusive culture, recruiting, retention, and continue to invest on ways to connect with talent from a variety of diverse backgrounds. Its goal is to increase minority diversity representation to 25% by 2025, “Progress toward this goal relies on intensifying our efforts that result in the increased promotion, advancement, and retention of female professionals and professionals of racial groups whose representation in the latest PPMD class is lower than overall PPMD representation.”

Similarly, PwC’s report shows that there is low levels of minority representation at the PPMD and Principal levels. As such, the firm has increased its efforts to retain employees through promotions, to increase diversity across all levels throughout the firm, “As we look at the data broken down by level, it shows that we are hiring women and racially/ethnically diverse candidates, but we are not retaining them at certain levels. That is why we are committed to intervening at key moments in our peoples’ career journey…with nontraditional recruiting, unconscious bias training and strategic collaborations with non-profit professional organizations.”

In my experience, if we want to attract minority accountants to become licensed CPAs, firms should focus on creating a more inclusive and unbiased culture, as well as increasing representation at higher levels of the organization. I have been in the accounting industry since 2005, after spending three years in commercial banking as a loan collateral analyst, right out of college. Throughout my accounting career, I have seen very little minority representation in private and public accounting.

The first nine years of my accounting career, I worked for small and medium size private companies in the asset management space. I was normally the only one in the room or one of the few. I never really felt that I belonged anywhere. First, I thought nothing of it, but after I transitioned to public accounting in 2015, I noticed the representation amongst diverse backgrounds was even worse. However, it is worth to mention that minority representation varied depending on office location.

At my last job, a Big Four, their NYC office workforce was very diverse, but I didn’t meet any Latinx. When I started working for the firm, I was scheduled to work on NYC company audits for few months, so I traveled to that office regularly. I felt more welcomed due to a more diverse workforce. I also created long lasting working relationships with some of my colleagues because I felt that belonged.

Unfortunately, after few months, I had to transfer to the Philadelphia office due to personal reasons. When I walked into that office, I immediately noticed the difference, there was no minority representation there. In my short tenure at that office, I only met two African American, four Latinx, including myself, and few Asians. I never felt that I belonged due to the lack of representation.

How can the CPA community help to increase a more diverse CPA pipeline?

I believe that increasing transparency and accountability amongst some of the largest CPA firms, is a good way to start the conversation about DEI. However, Deloitte and PwC DEI Reports showed that there is more work to be done. We should continue to focus on attracting young minority students when they are in middle school and high school, with career path introduction seminars, and finance literacy trainings to get them interested in the industry.

In addition, the results of the data showed that hiring minority college graduates is not the only problem, but also retaining and advancing them to a position of leadership. As such, emphasis on retaining these employees should be one of the main priorities, and identifying why they are leaving before reaching a manager level position. Furthermore, we should emphasize the need to implement unconscious bias training for leadership who are making important decisions regarding promotion, and advancement opportunities, to ensure performance reviews are completed fairly and without bias.

Lastly, as more organizations continue monitoring and reporting their workforce representation, they will also hold themselves accountable of the progress, to ensure they are on track to meeting their goals, and take the necessary steps if they are not. Hopefully, by monitoring and inviting more allies to join us in closing the diversity gap, we can attract, retain and increase a more diverse CPA pipeline.

“If you can’t see it, you can’t be It!”